Company News: Green Street Adds Advanced Sales Comps to College House, Driving Greater Platform Value

GSN Roundup: StoneX Buildout, Wells Fargo Industrial Purchase, and DRA+DLC Co-Venture

Top stories in US CRE News this week:

Asset Backed Alert 12.05.25

StoneX Plots ABS Banking Team Buildout

StoneX is laying the groundwork for a robust buildout of its capital-markets group.

The New York-based operation’s unit is slated to be led by Robert Sannicandro, who left Deutsche Bank in October after 10 years, with plans to join StoneX soon. He most recently ran a team that originates and structures bonds backed by nontraditional assets. StoneX’s effort initially will have a similar focus.

Matt Kirstein, head of agency and nonagency structured-product sales at StoneX, said the firm is looking to build a full-scale structured-product banking arm that will dole out warehouse lines and jockey for underwriting mandates on asset-backed bond offerings.

“Our goal here is to build a true securitization, lending and capital-markets group,” Kirstein said.

The team is positioned to benefit from Sannicandro’s relationships with issuers of bonds backed by so-called esoteric assets such as digital-infrastructure cashflows, renewable-energy receivables, timeshare loans, billboard leases and music royalties, among others. Eventually, the unit will look beyond those asset classes.

“One thing that’s advantageous for us at StoneX is that it’s a very large company and we have our hands in a lot of different businesses,” Kirstein said. “Our hope is to leverage a lot of their expertise and look toward some of these other asset classes that we may already be engaged with in other parts of StoneX.”

StoneX laid the foundation for its structured-product banking buildout in 2020 with a wave of hirings of sales and trading professionals. The firm then started beefing up its mortgage-backed securities banking team and grew to include a group specializing in collateralized loan obligations.

StoneX was not among the top 40 bookrunners of U.S. asset-backed securities offerings or the 25 largest bookrunners of U.S. CLOs through the first nine months of 2025, according to Asset-Backed Alert’s ABS Database. The company did place 24th among the 25 largest bookrunners of U.S. mortgage-backed bond deals with $305.2 million of credit for a single securitization, down from $778.6 million of credit for three transactions in the first three quarters of 2024.

StoneX last month hired former Deutsche banker Jacob Dabrowski amid a team buildout that will include bankers and other analytics professionals, starting with a head of ABS structuring and analytics.

While the initial banking effort will be U.S.-based, the long-term goal is for StoneX to expand its structured-product group overseas, Kirstein said.

“StoneX is a very internationally focused company,” he said. “We have a lot of touchpoints throughout the world, and we think there’s a tremendous opportunity to grow a capital-markets business internationally.”

Commercial Mortgage Alert 12.05.25

Wells Leads Loan on Big Industrial Purchase

Wells Fargo has originated a $515 million loan on a sweeping portfolio of industrial properties.

The borrower, Artemis Real Estate Partners, used the proceeds to finance the acquisition of an 8.7 million sq ft package from EQT Real Estate. The floating-rate debt, which has a total term of five years, closed two weeks ago, and the word is Wells could bring in one or more additional lenders to take down pieces of the deal. JLL advised Artemis on the financing and handled the sale for EQT.

The price tag for the portfolio approached $770 million, according to sister publication Real Estate Alert. That marked the largest industrial-property sale so far this year, according to Green Street’s Sales Comps Database.

EQT offered the portfolio via common shares in its REIT 1. The warehouses are about 95% leased to 25 tenants.

The package encompasses 25 buildings across 13 markets. The largest portions of the pool are three buildings apiece in and around Memphis (1.33 million sq ft), New York (1.26 million sq ft) and Florida (1.07 million sq ft). There also is a sizable concentration in the Phoenix market (854,000 sq ft, two buildings). Those markets account for nearly 61% of the portfolio’s net operating income, though there also are large presences in the markets of St. Louis (920,000 sq ft) and Chicago (892,000 sq ft).

Other properties are in Pennsylvania, the Dallas-Fort Worth area, Houston and Greenville, N.C. The locations generally are in infill areas with immediate access to large population centers and transportation corridors. The buildings range from 84,000 to 892,000 sq ft and have average ceiling heights of 30 feet. As of a few months ago, the weighted average remaining lease term was 4.2 years and in-place rents were 25% below market averages — conditions that could provide upside for Artemis, a Chevy Chase, Md.-based investment firm that was bought this year by Barings.

Radnor, Pa.-based EQT originally shopped REIT 1 early this year along with its REIT 2, which held 10.6 million sq ft of industrial assets. Sources put the combined projected value of both offerings at $2 billion. However, the firm later broke up the portfolios, along with a separate larger pool, into smaller chunks.

REIT 1 is Artemis’ biggest acquisition to date, according to the Sales Comps Database, topping a $157.5 million industrial purchase in 2024. The sale also represented EQT’s largest disposition in nearly four years.

Real Estate Alert 12.09.25

DRA, DLC Double Up With Big Retail Purchase

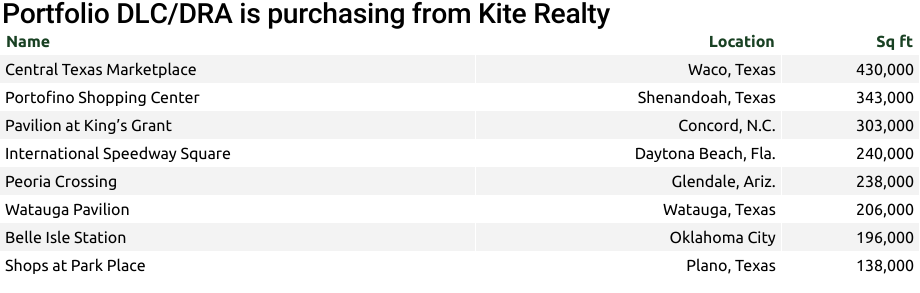

A venture between DRA Advisors and DLC Management this week paid Kite Realty $429 million for a portfolio of eight shopping centers, their second major purchase together this year.

The package comprises 2.1 million sq ft, with four properties in Texas and one each in North Carolina, Florida, Arizona and Oklahoma City. The portfolio is 91% leased, with tenants including Dick’s Sporting Goods, HomeGoods, Marshalls, Nordstrom Rack, Ross, T.J.Maxx, Total Wine and Ulta Beauty.

Kite announced the sale on Dec. 8 but did not disclose the buyer or the initial annual yield, which fell in the upper-7% area, sources said.

DLC, of Elmsford, N.Y., and New York-based DRA put together the deal with Indianapolis-based Kite on an off-market basis. The buyers have been among the most active retail players in the U.S. this year.

The transaction comes weeks after DLC and DRA announced the $625 million purchase of 10 West Coast retail properties from San Francisco-based Merlone Geier Partners. And in August, they paid $81 million for a Louisiana shopping center anchored by Whole Foods. All told, they say they have made $1.7 billion of acquisitions together in recent years.

The Kite purchase represents continued expansion for DLC, with the firm’s first acquisitions in Phoenix and Oklahoma, and a growing footprint in Texas and Florida. It followed the Merlone Geier deal, which came with plans to open a new West Coast office.

In 2023, DLC secured funding from Chicago-based Temerity Strategic Partners as part of a plan to purchase up to $2 billion of suburban shopping centers over three years via the partnership.

Kite, in its third-quarter earnings report, said it planned to close on $500 million of dispositions in the fourth quarter. The firm said that was part of “a significant strategic pivot toward higher-growth and lower-risk assets,” and that it also could redeploy some proceeds from sales to share buybacks and special dividends. To that end, the REIT disclosed this week it had bought back some $86 million in shares since that earnings call.

Kite has been a big seller this year. In addition to the sale to DLC and DRA, it has sold seven centers worth $424.25 million. But it also has been an active buyer, and teamed with GIC of Singapore in April on the $785 million purchase of Legacy West, a mixed-use property with retail space and apartments in the Dallas suburb of Plano, Texas.